Submitted by David Stockman via Contra Corner blog,

GE’s announcement that its getting out of the finance business should be a reminder of how crony capitalism is corrupting and debilitating the American economy. The ostensible reason the company is unceremoniously dumping its 25-year long build-up of the GE Capital mega-bank is that it doesn’t want to be regulated by Washington as a systematically important financial institution under Dodd-Frank. Oh, and that its core industrial businesses have better prospects.

We will see soon enough about its oilfield equipment and wind turbine business, or indeed all of its capital goods oriented businesses in a radically deflationary world drowning in excess capacity. But at least you can say good riddance to GE Capital because it was based on a phony business model that was actually a menace to free market capitalism. Its deplorable raid on the public purse during the Lehman crisis had already demonstrated that in spades.

Even MarketWatch’s coverage captured a hint of this illicit business model:

GE’s news release announcing its latest and greatest reduction of GE Capital summed up the move beautifully, saying “the business model for large wholesale-funded financial companies has changed, making it increasingly difficult to generate acceptable returns going forward.”

“Wholesale-funded” refers to GE Capital’s traditional reliance on the commercial paper market for liquidity. The problem with this short-term funding model for a balance sheet with long-term assets is that during a financial crisis, overnight liquidity tends to dry up as it did for GE late in 2008. When the company had difficulty finding buyers for its paper, the Federal Deposit Insurance Corp. stepped in and through its Temporary Liquidity Guarantee Program (TLGP) was covering $21.8 billion of GE commercial paper. GE Capital registered for up to $126 billion in commercial-paper guarantees under the TLGP.

General Electric obviously wishes to avoid ever needing another government bailout…..

Well, its not exactly that “the business model for large wholesale-funded financial companies has changed.” It was never valid in the first place. Indeed, the fact that GE assembled what was once a $600 billion wholesale funded bank is a testament to the destruction of honest financial markets by the Fed and other central banks.

In fact, GE Capital never had any secret sauce or competitive advantage. At the end of the day, it made its money by investing in long-dated, illiquid financial assets such as real estate, equipment leases, term loans, project finance deals and LBOs, and then funded them with cheaper, shorter term wholesale money. The assets were cold; the funding was hot.

So doing, it picked up billions of nickels in front of the proverbial steamroller—–that is, until the jig was suddenly up in September 2008. What occured next would was the deplorable $60 billion bailout by Washington, but that would never have occurred in an honest free market because the GE Capital house of cards could never have been erected.

The colossal commercial paper funding meltdown experienced by GE Capital in September 2008 would not have happened because an honest market would not have priced its commercial paper so cheaply. That is, its business model, which amounted to yield curve arbitrage, would not have been profitable. As a consequence, even a corporate value destroyer and crony capitalist plunderer like Jeff Immelt would not have been positioned to raid the US treasury in September 2008.

As it is, Immelt was given a thumbs up by the market on Friday for jettisoning GE Capital – even if it was largely for the wrong reason. Namely, that it was accompanied by another gigantic $50 billion share buyback promise – a raid on GE’s balance sheet that makes no sense as the company now plunges into the epochal deflationary era ahead as a “pure play” industrial which will need all the clean balance sheet it can get.

Never mind, through. Immelt did get GE’s stock price back to… .well, to its 1998 level! That’s 17 years to nowhere, but its better than the alternative.

When the next financial meltdown arrives, GE Capital would have been obliterated. And apparently even Obama’s chief business booster, General Electric’s CEO and Chairman, could see that next time even Washington would be coming not with TLGPs and other dollar-laden acronyms, but with torches and pitchforks.

![GE Chart]()

GE data by YCharts

In the Great Deformation, I singled out Immelt for a special place in the crony capitalist hall of shame. On the occasion of making the world (somewhat) safer by dismantling GE Capital, here is why its good that the latter is gone and that Immelt deserves everlasting ignominy for his rape of the US taxpayers last time around:

From The Great Deformation:

By that late hour, however, the Fed was not even remotely interested in financial discipline. The Greenspan Put had now been superseded by the even more insidious Bernanke Put. In defiance of every classic canon of sound money, the new Fed chairman had panicked in the face of the first stock market tremors in August 2007 (see chapter 23), and thereafter the S&P 500 had become an active and omnipresent transmission mechanism for the execution of central bank policy.

Consequently, after the Lehman event the plummeting stock averages had to be arrested and revived at all hazards. Accordingly, the bailout of AIG was first and foremost an exercise in stabilizing the S&P 500.

The cover story, of course, was the threat that a financial contagion would ripple out from the corpus of AIG, bringing disruption and job losses to the real economy. As has been seen, however, there was nothing at all “contagious” about AIG, so Bernanke and Paulson simply peddled flat-out nonsense in order to secure Capitol Hill acquiescence to their dictates and to douse what they derisively called “populist” agitation; that is, the noisy denunciation of the bailouts arising from an intrepid minority of politicians impertinent enough to stand up for the taxpayer.

But this hardy band of dissenters—ranging from Congressman Ron Paul to Senator Bernie Sanders—was correct. Everyday Americans would not have lost sleep or their jobs, even if AIG’s upstairs gambling patrons had been allowed to lose their shirts. Still, the bailsters peddled a legend which has persisted; namely, that in September 2008 the nation’s financial payments system was on the cusp of crashing, and that absent the bailouts American companies would have missed payrolls, ATMs would have gone dark, and general financial disintegration would have ensued. But this is a legend. No evidence has ever been presented to prove it because there isn’t any.

Take the case of GE Capital…

On the eve of the crisis about $650 billion, or one-third of prime fund assets, were invested in commercial paper, making these funds the largest single investor class in the $2 trillion commercial paper market. Consequently, when the wave of money moved from prime funds to government- only funds which could not own commercial paper, open market rates on the A2/P2 grade of thirty-day commercial paper spiked sharply. Loan paper that had yielded only 1 percent prior to the spring of 2008 suddenly soared to over 6 percent during the September crisis.

Any garden variety economist might have suggested that commercial paper had been seriously overvalued. The flight from prime funds was living proof that the market had been artificially buoyed by big chunks of demand from what were inherently risk-intolerant prime fund investors. Now, the commercial paper market was in a violent rebalancing mode, causing borrowers to experience the joys of “price discovery” as interest rates sought a higher, market-clearing level.

THE REAL BAILOUT CATALYST: JEFF IMMELT’S THREATENED BONUS

At that particular moment, however, General Electric CEO Jeff Immelt was apparently in no mood for a lesson in price discovery. In fact, he was then learning, along with the rest of Wall Street, an even more painful lesson about the folly of lending long and borrowing short. Notwithstanding that General Electric was one of just a handful of AAA-rated American corporations, it was suddenly discovering that its hugely profitable finance company, General Electric Capital, was actually an unstable house of cards.

GE Capital’s financial alchemy rested on a simple but turbocharged formula straight out of the Wall Street playbook. At the time of the crisis, GE Capital boasted $650 billion of financial investments from customized deals in real estate, equipment leasing, working capital finance, and private equity. While these highly proprietary investments yielded generous rates of return, they were also highly illiquid and prone to blow up at higher than normal loss rates, thus bearing an asset profile that called for generous amounts of equity capital funding. In fact, however, GE Capital’s massive balance sheet was leveraged nearly 10 to 1 and included upward of $100 billion of short-term commercial paper.

Needless to say, this huge load of commercial paper carried midget in- terest rates (4.7 percent), which helped fuel impressive profit spreads on GE’s assets. But this ultra-cheap CP funding also bore short maturities, meaning that GE Capital had to rollover billions of commercial paper debts day in and day out.

When commercial paper rates suddenly spiked during the Lehman crisis, GE was caught with its proverbial pants down. But rather than manning-up for the financial hit that his company deserved, Jeff Immelt jumped on the phone to Treasury Secretary Paulson and yelled “Fire!”

Within days, the sell-off in the commercial paper was stopped cold by Washington’s intervention, sparing GE the inconvenience of having to pay market rates to fund its massive pool of assets. The Republican government essentially nationalized the entire commercial paper market.

Even a cursory look at the data, however, shows that Immelt’s SOS call was a self-serving crock. His preposterous message had been that the commercial paper market was seizing up and that GE was on the edge of collapse—a risible proposition. Nevertheless, that assertion quickly became gospel among panic-stricken officialdom, and from there it rapidly spread to Wall Street and the financial press.

Not surprisingly, even two years later when the dust had settled and facts were readily available to refute this horary untruth, Secretary Paulson insisted upon repeating the GE legend in his memoirs. Describing round the clock staff activities on Wednesday, September 17, he noted that “our most pressing issue” had been to “help the asset-backed commercial paper market before it pulled down companies like GE.”

That was garbled nonsense. GE was not even a significant issuer of “asset-backed commercial paper” (ABCP). Those small amounts it did issue ($5 billion) were non-recourse and self-liquidating, meaning that GE Capital would have already passed ownership of the embedded assets to the ABCP conduit and its investors would have taken a hit, not GE.

By the same token, it was a huge issuer of unsecured commercial paper (100 billion), but even that was not remotely capable of felling the mighty GE. The required rollover funding was less than $5 billion per week, which was petty cash for a $200 billion (sales) global corporation with an AAA credit rating.

Although GE was not heading into a black hole, it was facing the need for a painful bout of liquidity generation which would have required either a fire sale of some of its sticky assets or a highly dilutive issuance of long term equity or debt capital. Both courses were feasible, but each would have resulted in a sharp blow to earnings and top executive bonuses.

Instead of allowing the free market to resolve the matter, however, the taxpayers were thrown into the breach in still another variation of stopping the alleged “run” on Wall Street’s cheap wholesale funding. Again, a necessary and healthy market correction was cancelled while the cronies of capitalism were kept in the clover.

WHY THE ATMS WOULD NOT HAVE GONE DARK: THE SECRET OF “GAIN ON SALE” ACCOUNTING

The commercial paper bailout incited by Jeff Immelt was utterly unnecessary. The facts show that the bailsters conjured up still more economic goblins where none actually existed. What the commercial paper bailout mainly did was prop up the banking industry’s “gain on sale” profit scam.

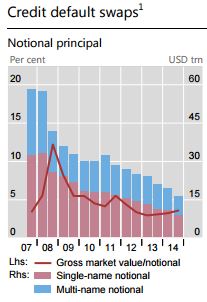

The single most salient fact about the $2 trillion commercial paper market was that upward of $1 trillion was accounted for by the aforementioned ABCP, or asset-backed commercial paper segment. This was just another form of securitization, and it amounted to the financial equivalent of a twice-baked potato.

In this instance, Wall Street had gone to the banks and credit card companies and purchased massive volumes of “receivables” representing payments owed on millions of auto loans, credit cards, student loans, and other installment credit. These receivables were then dumped into a “conduit,” which was a legal structure that existed only in cyberspace; the underlying payments on loans and credit cards were processed and collected by their bank and finance company originators.

Nevertheless, the conduits were given a top credit rating by S&P and Moody’s because they were over collateralized; that is, they had enough extra assets per dollar of ABCP issued to absorb any likely defaults by the underlying borrowers. Given these AAA ratings, the ABCP conduits were thus enabled to issue billions of commercial paper debt against their “assets,” which were actually, of course, debts of the American consumer.

The crucial point about this $1 trillion ABCP market, however, was that it did not originate new loans; it was merely a mechanism for refinancing debts which already existed. Accordingly, no consumer anywhere in America needed the ABCP market in order to swipe their credit card or get a car loan.

Instead, consumer loans of this type were being advanced, day in and day out, to the public by the likes of JPMorgan, American Express, Bank of America, and hundreds of other banks and finance companies. All of the money passing through cash registers from credit cards and into car purchases from auto loans flowed directly from these banks, not the ABCP market.

While the ABCP conduits accomplished nothing for the consumer, they did permit the banks to enjoy the magic of “gain on sale” accounting. Under the latter dispensation of the accounting profession, banks could immediately book the lifetime profits on these consumer loans the minute they were sold to the securitization conduit, even though such loans were months and even years from maturity.

The profits on a five-year car loan, for example, could be booked practically the day it was made. Likewise, credit card companies essentially had their profits fed intravenously; that is, within virtually the same digital nanosecond that a consumer’s credit card was swiped, there also transpired a nonrecourse sale of this credit card receivable to the conduit. Right then and there, by means of advanced technology and accounting magic, the bank issuer of the credit card was able to book the estimated “gain on sale” directly to its profit column.

So when Bernanke and Paulson regaled Capitol Hill about the “collapse” of the commercial paper market, what they neglected to mention was that the main thing collapsing was these quickie “gain on sale” profits at JP Morgan, Citibank, Capital One, and the rest of the issuers. No credit card authorization was ever denied nor was any car loan application ever rejected because the ABCP market melted down in the fall of 2008.

That the commercial paper market meltdown had never been a threat to the Main Street economy is now crystal clear: the amount of ABCP paper outstanding today is 75 percent smaller than in September 2008, but the banks have had no problem whatsoever funding credit card and other consumer loans on their own balance sheets out of their own deposits and other funding sources. In fact, the banking system is now actually so flush with cash that it is lending $1.7 trillion of excess reserves back to the Fed at the hardly measureable interest rate of 0.25 percent annually.

Another $400 billion layer of the $2 trillion commercial paper market had been issued by industrial companies and was used to meet working capital needs, including payroll. So it did not take the Washington bailsters long to conjure up frightening scenarios about millions of empty pay envelopes at the giant corporations which were heavy commercial paper users.

Had the bright young Treasury staffers racing around behind Hank Paulson’s flaming hair come from the loan department of a Main Street bank rather than the M&A wards of Wall Street, however, they would have known better. At the time of the crisis, there was hardly a single industrial company issuer of commercial paper that did not also have a “standby” bank line behind its program.

Indeed, such back up lines were mandatory features of industrial company commercial paper programs. They were designed to assure investors that if issuers could no longer roll over maturing commercial paper, they would make timely repayment by drawing down their standby lines at their bank.

Moreover, industrial company issuers paid an annual fee of 15 to 20 basis points on these standby credit lines, precisely so that banks would have a contractual obligation to fund if requested. In the event, none of the banks violated their legally enforceable loan contracts to fund these CP standby lines. There was never a chance that corporate payrolls would not be met.

CRONY CAPITALIST SLEAZE: HOW THE NONBANK FINANCE COMPANIES RAIDED THE TREASURY

The final $600 billion segment of the commercial paper market provided funding to the so-called nonbank finance companies, and it is here that crony capitalism reached a zenith of corruption. During the bubble years, three big financially overweight delinquents played in this particular Wall Street sandbox: GE Capital, General Motors Acceptance Corporation (GMAC), and CIT. And all three booked massive accounting profits based on a faulty business model.

When a financial company lends long and illiquid and funds itself with short-term hot money, it needs to regularly charge its income statement with a loss reserve for the inevitable, violent moments of financial crisis when short-term money rates spike or funding dries up completely. At that point, a fire sale of assets at deep losses becomes unavoidable in order to scrounge up cash to redeem their hot-money borrowings as they come due daily.

The big three nonbank finance companies had not provided such rainy day reserves. Consequently, when the commercial paper market seized up, Mr. Market came knocking, intent on rudely clawing back years’ worth of overstated profits. In short order, however, the two largest of these giant finance companies, GE and GMAC, received taxpayer bailouts, proving once again that in the new régime of crony capitalism the kind of muscle which ultimately mattered was political, not financial.

The single most malodorous of the big finance companies was General Motors Acceptance Corporation, which went by the innocent-sounding acronym of GMAC. But it wasn’t innocent in the slightest, perhaps hinted at by the fact that its chairman was one Ezra Merkin, whose major line of business had famously been in the operation of multibillion-dollar feeder funds for Bernie Madoff.

GMAC was not only a huge purveyor of some of the worst slime in the subprime auto loan and home mortgage market, but it was also a giant financial train wreck waiting to happen. Leveraged at more than 10 to 1 and funded with massive amounts of short-term commercial paper, it had no ability to absorb even mild losses in its loan book.

GMAC was in the business of accumulating truly rotten loans. Its operating units appear to have scoured subprime America looking for “twofers.” Thus, the notorious Ditech online mortgage operation put millions of financially strapped households in homes they couldn’t afford. Then it compounded the favor by putting a new car in their garage via a six-year subprime auto loan that was “upside down” (i.e., greater than the value of the car) nearly from day one.

Many of the “twofer” households lured into unsustainable debt by GMAC’s subprime predators defaulted on their auto and mortgage loans when housing prices crashed and the economy buckled. As a consequence, GMAC ended up writing down $25 billion of loans, or more than the cumulative profits it had booked during the previous several years.

By every rule of capitalism, an enterprise as foolish, dangerous, predatory, and insolvent as GMAC should have been completely liquidated by a financial meltdown which was functioning to purge exactly that kind of deformation. Instead, it has remained on federal life support owing to $16 billion in TARP funding and an additional $30 billion in guarantees and subventions from FDIC and the Fed.

Yet there is not a shred of evidence that the Main Street economy has benefited from GMAC’s artificial life extension program. There has never been a shortage of solvent banks, thrifts, and finance companies to serve the auto and housing finance needs of the nation’s diminished pool of creditworthy borrowers. So when the Washington bailsters stopped the commercial paper meltdown on grounds that the likes of GMAC were imperiled, they snatched defeat from the jaws of victory.

Washington’s $30 billion lifeline to AAA-rated General Electric was no less gratuitous. At the time of Immelt’s SOS call to Secretary Paulson a day after the Lehman bankruptcy filing, the stock and bond markets were in a state of turbulence and panic. Even under those dire conditions, however, the world’s capital markets were still valuing GE’s common stock at $200 billion and were trading its $400 billion of term debt at a hundred cents on the dollar. Thus, as measured by the fundamental metric of corporate finance known as “enterprise value” (debt plus equity), the markets were capitalizing General Electric at $600 billion during the very midst of the meltdown.

This puts the lie to an urban legend assiduously promoted by the bailsters at the time and repeated endlessly by their apologists ever since. Their preposterous claim was that the $600 billion globe-spanning behemoth known as General Electric could not find replacement financing for the approximate $25 billion of commercial paper scheduled to mature on a fixed schedule (i.e., it was not subject to call on demand) between September 15 and the final months of 2008. The very idea that GE had been incapable of raising even a billion dollars of funding per business day was ludicrous on its face.

That this proposition was seriously embraced by mainstream opinion is undoubtedly a measure of the panic which had been shamelessly induced by the Washington bailsters. The true facts of the case, of course, were more nearly the opposite. GE Capital could have readily generated sufficient cash to meet its CP redemption obligations by selling only 8 percent of its assets, even at fire-sale discounts of up to 50 percent of book value, if that had been necessary.

In the alternative, the GE parent corporation could have raised new debt and equity capital, again at whatever deep discounts might have been demanded by the distressed markets of the moment. For example, a 4 percent increase in its long-term debt would have raised $15 billion, even if it required a coupon double GE’s average 5 percent rate. And a mere 10 percent increase in its outstanding common shares would have raised $10 billion, even had they been placed at $10 per share or 50 percent below its $20 stock price at the time.

Thus, the mix of potential asset disposals and stock and bond issuance available to GE was nearly infinite. Any combination chosen would have generated sufficient cash to redeem its expiring commercial paper. Indeed, it is blindingly obvious that the taxpayer-supported bailout of General Electric was simply about earnings per share and the threat to executive bonuses that would have resulted from asset sales or stock and bond offerings.

The fact is, these “self-help” methods of raising cash according to free market rules would have also have whacked GE’s earnings by perhaps $2 per share, owing to losses or earnings dilution. Either way, shareholders would have gotten the beating they deserved for having so egregiously overvalued GE’s debt-inflated earnings and for putting such reckless managers in charge of the store.

Instead, GE shareholders were spared any permanent damage. Likewise, GE and GMAC had combined long-term debt outstanding of nearly a half trillion dollars, all of which remained worth a hundred cents on the dollar, thanks to Uncle Sam’s safety nets.

This means that the bond fund managers who were the “enablers” of these unstable finance company debt pyramids got off without a scratch. So the pattern was repeated over and over. The post-Lehman meltdown in the wholesale money markets, including the various types of commercial paper, was of consequence only in the canyons of Wall Street. The thin slab of permanent debt and equity capital that supported these bubble-era pyramids of inflated assets and toxic derivatives was the only real target of Mr. Market’s wrathful attack.

Had this attack been allowed to run its course, hundreds of billions in long-term debt and equity capital that underpinned the Wall Street–based speculation machines would have been wiped out, including huge amounts of stock owned by executives and insiders. Such a result would have been truly constructive from a societal vantage point. It would have implanted an abiding 1930s style generational lesson about the deadly dangers of leveraged speculation.

BERNANKE’S PANICKED DEPRESSION CALL

At the end of the day, the stated purpose of the Wall Street bailouts—to avoid a replay of the 1930s—was drastically misguided. It was based on a phantom threat which arose overwhelmingly from the faulty scholarship of a single official: the former math professor who had come to head the nation’s central bank. The analysis was actually not even his own, but was the borrowed theory of Professor Milton Friedman.

Forty years earlier, Friedman had famously claimed that the Fed’s failure to run its printing presses full tilt during certain periods of 1930–1932 had caused the Great Depression. Bernanke’s sole contribution to this truly wrong-headed proposition was a few essays consisting mainly of dense math equations. They showed the undeniable correlation between the collapse of GDP and the money supply, but proved no causation whatsoever. In fact, as will be shown in chapters 8 and 9, the great contraction of 1929–1933 was rooted in the bubble of debt and financial speculation that built up in the years before October 1929, not from mistakes made by the Fed after the bubble collapsed. In the fall of 2008, the American economy was facing a different boom-and-bust cycle, but its central bank was now led by an academic zealot who had gotten cause and effect upside-down.

The panic that gripped officialdom in September 2008, therefore, did not arise from a clear-eyed assessment of the facts on the ground. Instead, it was heavily colored and charged by Bernanke’s erroneous take on a historical episode that bore almost no relationship to the current reality.

Nevertheless, the bailouts hemorrhaged into a multi trillion dollar assault on the rules of sound money and free market capitalism. Moreover, once the feeding frenzy was catalyzed by these errors of doctrine, it was thereafter fueled by the overwhelming political muscle of the financial institutions which benefited from it.

These developments gave rise to a great irony. Milton Friedman had been the foremost modern apostle of free market capitalism, but now a misguided disciple of his great monetary error had unleashed statist forces which would devour it. Indeed, by the end of 2008 it could no longer be gainsaid. During a few short weeks in September and October, American political democracy had been fatally corrupted by a resounding display of expediency and raw power in Washington. Every rule of free markets was suspended and any regard for the deliberative requirements of democracy was cast to the winds.

Henceforth, the door would be wide open for the entire legion of Washington’s K Street lobbies, reinforced by the campaign libations prodigiously dispensed by their affiliated political action committees (PACs), to relentlessly plunder the public purse. At the same time, the risk of failure had been unambiguously eliminated from the commanding heights of the American economy. Free market capitalism thus shorn of its vital mechanism to purge error and speculation had become dangerously unhinged.

Yet the September 2008 meltdown was a financial cyclone which struck mainly within the vertical canyons of Wall Street, and would have burned out there in short order. This truth exposes the crony capitalist putsch that occurred in Washington during the fall of 2008 and invalidates its self serving narrative that America was faced with a continent-wide flood which would have wracked devastation across the length and breadth of Main Street America.

There was never any evidence for Bernanke’s Great Depression bugaboo, a truth more fully explicated in chapters 28 and 32. So it is also not surprising that bailout apologists cannot explain the origins of the Wall Street meltdown. Indeed, they treat it as sui generis, meaning that the “contagion,” whatever it was, had suddenly arrived as if on a comet from deep space. And after hardly a ten-week visit, as measured by the return of speculators to the beaten-down bank stocks in early 2009, it had adverted once again to interstellar blackness.

It is not surprising, therefore, that the corporals’ guard of Treasury and Federal Reserve officials who carried out this financial coup d’état never once provided any detailed analysis of why this mysterious “contagion” had struck so suddenly; nor did they ever lay out the financial system linkages and pathways by which the contagion was expected to spread; nor did they present any review of the costs, benefits, and alternatives to bailing out the major institutions which were rescued. Hardly a single page of professionally competent analysis and justification for the Wall Street bailouts was presented to the president or any of the leaders of Congress at the time.

Indeed, the Bernanke–Paulson putsch was so imperious and secretive that Sheila Bair, head of the FDIC and the one regulator who thoroughly understood the balance sheet of the American banking system, and also did not buy into knee-jerk fear mongering about “systemic risk,” was simply not consulted, and commanded to fall in line. As Bair recounted the events, “We were rarely consulted . . . without giving me any information they would say, ‘You have to do this or the system will go down.’ If I heard that once, I heard it a thousand times . . . No analysis, no meaningful discussion. It was very frustrating.”

Sheila Bair was the single best informed and most tough-minded and courageous financial official in Washington at the time of the crisis. She had a sophisticated grasp of the manner in which deposit insurance had been abused to fund excessive risk taking in the banking system and a resolute conviction that the capital structure enablers—that is, bank bond and equity holders—needed to absorb losses ahead of the insurance fund and taxpayers.

None of this was remotely understood by Paulson’s cadre of former Goldman associates led by Neel Kashkari. He was a thirty-four-year-old former space telescope engineer who had done two-bit M&A deals in Goldman’s San Francisco office for two years before joining the Treasury Department and being assigned the bailout portfolio.

The fact that the abysmally unqualified Kashkari led the bailout brigade while Bair was systematically excluded from the process speaks volumes as to how completely public policy had fallen into the clutches of Wall Street. Kashkari and his posse had no sense whatsoever about the requisites of sound public finance. So in the fog of Washington’s panic, prevention of private losses quickly and completely supplanted any reasoned consideration of the public good.

![]()

![]()

![]()

![]()

![]()

![]()

![]()